This article is co-authored by Luo Xuhong and Adeline Li.

Cover image credit: Stacey Ngiam

China's economy, once a powerhouse of rapid growth and industrial expansion, has faced persistent headwinds in recent years. Economic growth has slowed due to the presence of several deep-rooted issues, worsened by the lasting effects of COVID-19 and uncertainties in the global economy. The country is simultaneously facing three major headwinds: a worsening property market crisis, sluggish consumer spending, and rising government debt. To address these challenges, the Chinese government has launched various financial policies and stimulus measures. However, it’s still unclear whether these efforts will be enough to turn things around.

The Property Market Crisis

The Chinese property sector, which traditionally contributed nearly 30% of GDP through direct and indirect channels, has experienced a severe downturn. Real estate is typically seen as the cornerstone of retirement planning in China: numerous Chinese families park savings in an apartment situated in a prime district. Well, not anymore. First sparked by the “three red lines” policy aimed at curbing excessive indebtedness, overleveraged developers swiftly found themselves unable to repay huge sums. Developers, previously reliant on pre-sales as the main funding mechanism, faced financial strain when these sales declined sharply during the COVID-19 pandemic, in turn triggering a plunge in property sales, new construction, and land transactions. In turn, this drop affected local government finances, which in recent years had increasingly relied on revenues from land sales. As a result, government debt is now some 75% of GDP; when including debt incurred by local government financing vehicles (LGFVs), that figure approaches 100%. In an attempt to boost the property market, China has rolled out the “whitelist” initiative in January 2024, which allows city governments to recommend residential projects to banks for speedier lending so as to ensure the completion of unfinished housing projects so they could finally be delivered to buyers.

However, volatility in the Chinese stock market is also expected to continue as investors “lack conviction that the stimulus package and what’s been announced is going to turn around things,” said Chi Lo, senior economist at BNP Paribas Asset Management. In any case, the impact in the short run is limited as confidence in the sector remains weak.

To address the crisis, the Chinese government has introduced a series of measures in September 2024 to revitalise the real estate sector. The new package aims to make borrowing easier across the economy, with a strong focus on the housing market. Key policies include cuts to the reserve requirement ratio (RRR), policy interest rates, mortgage rates, and the minimum down payment for second homes. Additionally, the re-lending programme for the housing stock buy-back scheme will be strengthened, and restrictions on the equity market will be loosened.

*The required reserve ratio (RRR) refers to the % of deposits that a bank must hold as part of its liquid reserves and not loan out. Usually determined by the central bank, it is used as a monetary policy tool to maintain liquidity within financial markets. A lower RRR allows Chinese banks to redeploy capital to other uses, such as offering loans for real estate transactions.

While these measures have led to some short-term improvements, analysts caution that these policies may not be sufficient. Long-term solutions must also include addressing developers' debt overhang and shifting away from the overreliance on property as an economic driver.

However, there is also cause for cautious optimism. As per a S&P report issued in January 2025, some analysts have suggested that the worst may be over and China’s real estate is expected to stabilise as a result of a faster expected recovery of the secondary sales market. The measures discussed above have made new purchases more affordable and some buyers have responded positively to the policy adjustments. Leading the rebound is the sale of high-end homes in first-tier cities such as Guangzhou and Shanghai but smaller cities are expected to follow suit as well. Barring another major default by a developer, consumer sentiment may recover enough to propel a slow but sustained recovery in 2025.

Weak Domestic Consumption: A Herculean Task

China has struggled with persistently weak consumer demand, revealing deeper structural issues. The root cause lies in the slow growth of household incomes, which is a key factor limiting consumption growth. In the first half of 2024, the per capita disposable income growth rate for urban residents was only 4.5%, significantly lower than the GDP growth rate for the same period. Other factors include high household savings (as characteristic of Asian culture), poor job prospects, and “consumption downgrades” where consumers opt for cheaper alternatives have contributed to subdued spending. The situation has only worsened during the pandemic, especially due to China’s strict zero-COVID policies. Lockdowns and business closures led to massive job losses, hitting the service sector the hardest. Before the pandemic, this sector created around 10 million jobs a year, but during lockdowns, that number dropped to a mere 1 million.

The Chinese government’s September 2024 stimulus package aimed to stimulate domestic consumption through a series of fiscal measures. Key features include:

RMB 500 billion asset swap facility for non-bank financial institutions. The PBOC will allow non-bank financial institutions (such as mutual funds, insurance companies, and brokers) to borrow money directly from the central bank. They will use their high-quality assets (such as bonds) as collateral (security for the loan).

RMB 300 billion re-lending program for corporate buybacks, specifically for companies to repurchase their own stocks, so reduce circulating stocks, increase stock prices, increase consumer confidence in stock markets

Lower mortgage rates and easier home loan terms to incentivize property purchases.

Efforts to vigorously boost consumption… and expand domestic demand

Central Economic Work Conference held in December 2024, a meeting of Party leadership that sets the economic agenda for the year ahead.

Entering into 2025, the Communist Party leadership has made efforts to boost its historically low household consumption rates a key priority. While this rebalancing act has been on the radar of the Chinese leadership since at least 2 decades ago, household consumption as a total share of GDP in China remains significantly below that of the OECD average of ~60%. Moreover, data has shown that household consumption as a share of GDP has actually decreased in recent years, likely as a result of widespread pessimism. This is especially the case for the middle-class squeezed by the property market collapse and Beijing’s crackdown on the tech sector.

One main policy that China is banking on to boost consumption is the expansion of its existing consumer goods trade-in program. First rolled across various Chinese cities in early 2024, the scheme offers subsidies for purchases of certain big ticket items and has proven popular among many consumers keen on stretching their dollar. This year, more categories of household appliances and passenger vehicles are expected to be newly eligible under the scheme with 300bn of proceeds from “ultra-long special treasury bonds” issued in November 2024 used to finance it.

Thus far, data from the Ministry of Commerce has indicated that the scheme has boosted sales of automobiles by 920 billion yuan in 2024, and that of home appliances by 240 billion yuan. However, lessons from earlier rounds of consumption vouchers issued in 2022-3 at the height of the pandemic should also be taken into account. Government audits have revealed that such vouchers had significantly less impact than anticipated while misuse of these vouchers were recorded in some cities in Hainan and Zhejiang provinces. Regardless, schemes to boost household consumption (whether in the form of subsidies, vouchers or rebates) are likely to only provide a short-term boost especially given Beijing’s historical reluctance towards offering direct cash handouts.

Rising Government Debt

China’s total government debt has reached alarming levels, with official figures at 75% of GDP and an estimated 100% when including off-the-books debt from local government financing vehicles (LGFVs). Since LGFVs are not part of local government budgets, their debts are off-balance-sheet, meaning they are not officially recorded as government debt. Local governments have borrowed heavily to fund infrastructure projects, but many of these projects fail to generate sufficient revenue, creating a cycle of unsustainable debt accumulation. The problem is made worse by a slowdown in property sales, which local governments rely on for income. With fewer land sales, they have less money to repay their debts.

In response, China’s RMB 10 trillion fiscal stimulus package in September 2024 introduced measures to address local government debt, aiming to eliminate hidden debt by 2028 as part of China’s ten-year debt resolution plan. These include:

Increasing the local government debt limit by RMB 6 trillion, thus freeing up local governments to once again implement stimulus measures where appropriate and necessary. This gradual approach helps lower debt-servicing costs, giving local governments more financial flexibility to regain stability and support overall economic resilience.

Issuance of RMB 4 trillion of special local government bonds to refinance high-interest debts.

Establishment of a RMB 500 billion asset swap facility to stabilize non-bank financial institutions.

Finance Minister Lan Fo’an noted that the outstanding scale of hidden debt was around RMB14.3 trillion. With the newly rolled out measures, the burden on local governments should be significantly alleviated. The Ministry of Finance also called for a zero-tolerance approach for future hidden debt to avoid this sort of risk re-appearing in the future. However, while these measures offer short-term relief, some analysts argue that more structural changes must be rolled out for long-term success. Specifically, the root cause of local debt buildup (weak fiscal oversight and accountability) must be resolved. While the restructuring package is definitely a good starting point, it needs to be followed by long-term reforms to ensure lasting fiscal stability.

Chinese Monetary Policy

While China’s economic crisis shows no signs of abating, the world’s second largest economy remains reluctant to devalue its currency. In fact, PBOC governor Pan Gongsheng has instead issued firm guidance and announced a slew of measures to defend the yuan in early 2025. Let’s examine some of these below.

In his previous role as Director of the State Administration of Foreign Exchange from 2016-2023, Pan was responsible for safeguarding China’s war chest of foreign reserves worth more than $3trn. The technocrat is certainly keen to avoid a repeat of the modest devaluation of RMB almost a decade ago in Aug 2015 (due to technical reasons) that was immediately followed by an unprecedented capital flight as foreign investor confidence swiftly evaporated. Over the subsequent year and a half, Beijing spent almost $1 trillion in foreign reserves to stabilize the yuan and stem further devaluation pressures. Moreover, any devaluation would also put off many from utilising the RMB as a settlement currency, reversing years of efforts to encourage trading partners to use the RMB as an alternative to the USD.

In addition, a major devaluation would likely attract the ire of Trump, who has already made good on his promise to implement tariffs of 10% on all Chinese imports as of February 2025. Back during Trump’s first term, China’s decision to devalue its currency to blunt the impacts of tariffs only further angered Trump, who proceeded to implement more tariffs on an expanded range of goods (and labelled China a currency manipulator). This time round, Trump has also included a clause that explicitly permits him to implement even higher tariffs should the Chinese government retaliate. While initially announcing “unspecified countermeasures”, Beijing swiftly retaliated with tariffs on a variety of US resource exports and opened an antitrust probe into Google.

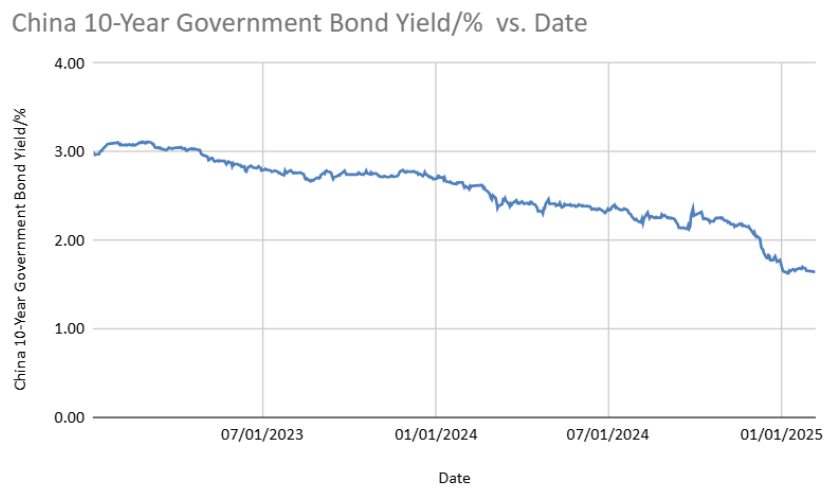

Pan Gongsheng’s policy measures have signalled Beijing’s willingness to defend its currency, for now. Since 2024, the PBOC has issued repeated warnings against currency speculation. In a surprise announcement in Jan 2025, the PBOC suspended its bond buying program, citing the need to discourage excessive speculation in the local bond market. Analysts have suggested that the move was aimed at defending the RMB and increasing Chinese bond yields (bond prices have an inverse correlation to yields) in line with bond markets in the rest of the world. In fact, yields on China's 30-year government bond have plunged to fresh lows as of the date of publication, 12 Feburary. Other moves aimed at shoring up the RMB include an unprecedented issuance of offshore RMB bills worth 60 billion yuan in Hong Kong with a 6-month maturity. In all likelihood, we expect the PBOC to favour an orderly depreciation throughout 2025 as Trump’s tariff threat becomes clearer.

2025 and Beyond

In sum, China’s September 2024 stimulus package is aimed at tackling three major economic problems: the property market downturn, weak consumer spending, and mounting government debt. To boost the property market sector, measures include lower mortgage rates, reduced down payments, and enhanced re-lending programs. To boost consumer consumption, policies are focused on supporting businesses through corporate stock buybacks and financial support for non-banking institutions. To reduce local government debt, the package provides RMB 10 trillion in debt restructuring, increased bond limit and special bonds. While these steps provide short-term relief, long-term financial stability will depend on other wide-ranging economic and fiscal reforms that address the underlying structural issues. Moving forward in 2025, more forceful stimulus measures beyond those discussed above will be necessary to restore consumer confidence. Beyond brief periods of shopping discounts and platform subsidies, policies that stabilise and boost household income will be essential to restore confidence in the economy. Finally, we expect a controlled devaluation of the RMB in line with established economic fundamentals.

References

Assessing China’s latest stimulus measures. WAM. (2024, October 9). https://www.manulifeim.com.hk/en/insights/impacts-on-china-equities-after-stimulus-package.html

Bao, A. (2024, October 17). China pledges more financial support for “whitelist” real estate projects. CNBC. https://www.cnbc.com/2024/10/17/chinas-housing-ministry-to-hold-briefing-on-efforts-to-bolster-the-property-market.html

China grappling with weak consumer demand. Chinadaily.com.cn. (2024, September 30). https://global.chinadaily.com.cn/a/202409/30/WS66f9e73fa310f1265a1c59e5.html

China holds Central Economic Work Conference to make plans for 2025. (2024, December 13). http://en.cppcc.gov.cn/2024-12/13/c_1052904.htm

China reaction: Monetary easing delivered, now waiting for fiscal coordination | AXA IM UK. (2024, September 24). https://www.axa-im.co.uk/research-and-insights/investment-institute/macroeconomics/market-alerts/china-reaction-monetary-easing-delivered-now-waiting-fiscal-coordination

China to expand consumer goods trade-in program to spur growth. (2025, January 8). https://english.www.gov.cn/news/202501/08/content_WS677e22e4c6d0868f4e8ee9c4.html

China’s economy ahead of the third plenum: The end of the “China Miracle”? Asia Society. (2023, October 4). https://asiasociety.org/policy-institute/chinas-economy-ahead-third-plenum-end-china-miracle

China’s Politburo revives crisis-era language in pledge to bolster economy. South China Morning Post. (2024a, December 9). https://www.scmp.com/economy/policy/article/3289978/chinas-politburo-promises-proactive-moves-bolster-domestic-demand-2025

Explainer: What makes China’s ultra-long “special bonds” so special? South China Morning Post. (2024b, November 20). https://www.scmp.com/economy/policy/article/3287255/what-makes-chinas-ultra-long-special-bonds-so-special

Lee, L. C. (2024, November 8). China unveils $1.7 trillion package to address mounting local debt woes. – The Diplomat. https://thediplomat.com/2024/11/china-unveils-1-7-trillion-package-to-address-mounting-local-debt-woes/

Martin, N. (2024, December 9). China plans stimulus gamble as Trump’s tariffs loom – DW – 12/09/2024. dw.com. https://www.dw.com/en/china-liquidity-economy-yuan-trump-tariffs-v1/a-70839175

My take: Beijing to fiercely defend yuan exchange rate in 2025 to avoid a repeat of 2015. South China Morning Post. (2025a, January 7). https://www.scmp.com/opinion/china-opinion/article/3293585/beijing-likely-fiercely-defend-yuan-exchange-rate-2025-lessons-2015-have-been-learned

My take: The US$3.2 trillion question: How much of China’s forex reserves for Hong Kong? South China Morning Post. (2025b, January 20). https://www.scmp.com/opinion/china-opinion/article/3295512/beijings-us32-trillion-question-how-much-chinas-forex-reserves-go-hong-kong

No quick fixes: China’s long-term consumption growth. – Rhodium Group. (n.d.). https://rhg.com/research/no-quick-fixes-chinas-long-term-consumption-growth/

Song, L. (2024a, November 8). China announces huge debt package ahead of “forceful” stimulus. ING Think. https://think.ing.com/snaps/china-announces-rmb-10tn-package-to-set-up-forceful-fiscal-stimulus-ahead/

Song, L. (2024b, December 4). Three calls for China: Steady, but headwinds are getting stronger. ING Think. https://think.ing.com/articles/three-calls-for-china-steady-amid-rising-headwinds/#a3

Speech by governor Pan Gongsheng at the Opening Ceremony of Asian Financial Forum. (n.d.). http://www.pbc.gov.cn/en/3688110/3688172/5552468/5564137/index.html

The Standard. (2025, January 6). PBOC outlines “moderately loose” monetary policy. https://www.thestandard.com.hk/section-news/section/11/269148/PBOC-outlines-%27moderately-loose%27-monetary-policy

Comments